Best Budgeting Apps for Beginners

Nearly half of households in the United States carry credit card debt, and a significant 37% of Americans struggle to cover a $400 unexpected expense with cash. This financial strain highlights the importance of effective budgeting and money management.

Managing personal finances has become more accessible with the rise of specialized budgeting apps designed for beginners. These apps offer intuitive interfaces that help track expenses, categorize spending, and visualize financial goals without requiring extensive financial knowledge.

By leveraging these tools, individuals can take control of their money and make informed decisions about their financial resources. In this article, we’ll explore the top budgeting apps of 2025 that offer the best features for beginners.

Key Takeaways

- Top budgeting apps for beginners offer intuitive interfaces and robust features.

- Effective budgeting apps help track expenses and categorize spending.

- These apps enable users to visualize financial goals and make informed decisions.

- We’ll explore both free and premium budgeting apps with advanced capabilities.

- Each app is evaluated based on ease of use, account syncing, and overall value.

Understanding the Value of Budgeting Apps

In today’s fast-paced world, managing finances has become a challenging task, but with the right tools, it can be simplified.

A budget is essentially a plan for your money, outlining how you will allocate your income towards different aspects of your life. To create an effective budget, you need to have a clear understanding of your financial situation.

Why Tracking Your Finances Matters

Tracking your finances provides crucial visibility into your spending habits and helps identify areas where you might be overspending without realizing it. Regular financial tracking allows you to make informed decisions about your money and ensures you’re allocating resources according to your priorities and values.

- Gain a clear picture of your spending habits

- Identify areas of overspending

- Make informed financial decisions

How Budgeting Apps Can Transform Your Financial Health

Budgeting apps simplify the often tedious process of manual expense tracking by automatically categorizing transactions and providing visual representations of your spending patterns. These tools can transform your financial health by highlighting problematic spending habits, encouraging saving behaviors, and helping you work toward specific financial goals.

By using a budgeting app, you can take control of your finances, reduce financial anxiety, and make progress towards achieving your financial objectives.

Key Features to Look for in Budgeting Apps

With numerous budgeting apps available, identifying the key features that matter most is essential for making an informed decision. The effectiveness of a budgeting app is largely determined by its ability to sync with your financial accounts, track transactions accurately, categorize expenses, and help you set financial goals.

Account Syncing and Transaction Tracking

A good budgeting app should allow you to sync your bank accounts, credit cards, and investment accounts seamlessly. This feature enables the app to automatically import transactions, saving you the time and effort of manual entry. By having all your financial data in one place, you can get a clear picture of your financial situation.

Expense Categorization and Reporting

The best budgeting apps offer customizable expense categorization systems. This feature lets you organize your spending into categories that make sense for your financial situation, such as housing, transportation, and entertainment. Comprehensive reporting features provide visual representations of your spending patterns through charts and graphs, making it easier to identify trends and stay on top of your finances.

Goal Setting and Planning Tools

Goal-setting tools are another crucial feature to look for in a budgeting app. These tools help you establish specific financial objectives, such as building an emergency fund, saving for a vacation, or paying down debt. With progress tracking, you can stay motivated to achieve your financial goals. Additionally, planning tools allow you to project future expenses and income, helping you prepare for upcoming bills and avoid cash flow problems.

When choosing a budgeting app, it’s also important to consider the security features. Look for apps that offer bank-level encryption and robust security measures to protect your sensitive financial information.

Free vs. Paid Budgeting Apps: What’s Worth Your Money

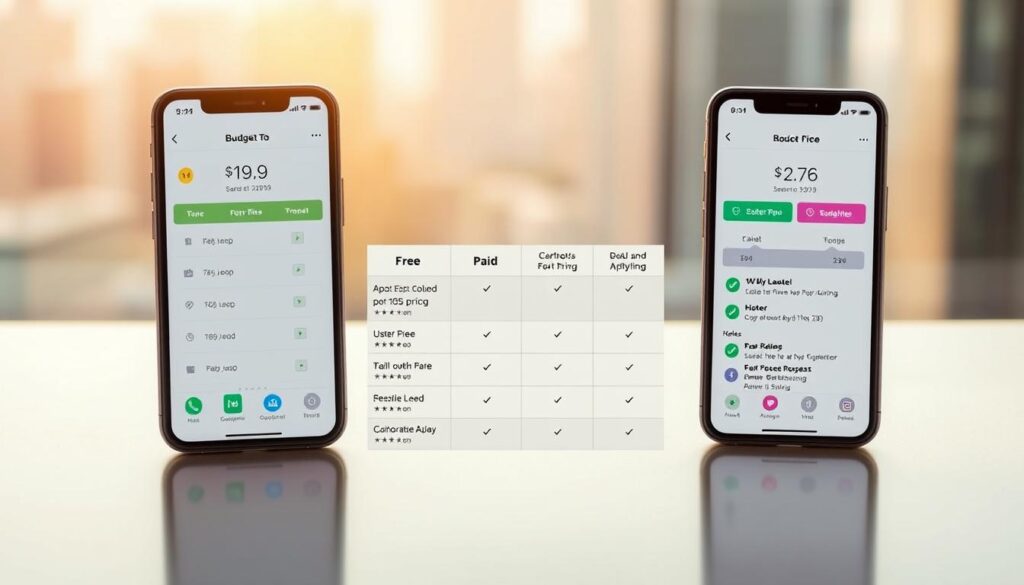

The decision to use a free or paid budgeting app hinges on the user’s financial needs and the level of service required.

When choosing a budgeting app, users must consider the trade-offs between cost and functionality.

What You Get With Free Budgeting Apps

Free budgeting apps typically offer basic features such as expense tracking and simple categorization.

These apps can be a good starting point for those new to budgeting, as they provide a basic understanding of financial management.

However, free versions often come with limitations, such as restricted customization options or advertisements, which can impact the user experience.

Premium Features That Might Be Worth Paying For

Paid budgeting apps, on the other hand, offer more comprehensive features, including unlimited account syncing, detailed reporting, and advanced goal tracking capabilities.

Some premium features include debt payoff strategies, investment tracking, and collaborative budgeting for couples or families.

When deciding between free and paid options, users should consider their financial needs and how committed they are to using the app.

Different Budgeting Methods Supported by Apps

Understanding the different budgeting methods supported by apps is crucial for effective financial planning. Budgeting apps vary in their approaches, with some using specific methods like zero-based budgeting or envelope budgeting, while others offer more generalized budgeting tools that can be customized to fit individual needs.

Zero-Based Budgeting

Zero-based budgeting is a meticulous approach that requires allocating every dollar of your income to specific categories until you reach zero. This ensures that all your money has a designated purpose. Apps that support zero-based budgeting help track where every dollar goes and prompt you to reassign funds when you overspend in certain categories.

Envelope Budgeting

Envelope budgeting is a traditional method where you allocate specific amounts to different spending categories, or “envelopes.” Once an envelope is empty, you stop spending in that category. Digital envelope systems in apps simulate this physical process, helping you visualize your remaining funds in each category throughout the month.

50/30/20 Budgeting

The 50/30/20 budgeting method suggests allocating 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. Apps that support this method automatically categorize your expenses and show your progress toward these percentage-based goals.

| Budgeting Method | Description | App Support |

|---|---|---|

| Zero-Based Budgeting | Allocate every dollar to specific categories | Track expenses, reassign funds |

| Envelope Budgeting | Allocate amounts to spending categories | Digital envelope systems, visualize remaining funds |

| 50/30/20 Budgeting | Allocate 50% to needs, 30% to wants, 20% to savings | Automatic expense categorization, progress tracking |

By understanding which budgeting method works best for your personality and financial habits, you can select an app that supports your preferred approach, making it easier to stick to your budget and achieve your financial goals.

YNAB (You Need A Budget)

The YNAB budgeting app is designed to help users take control of their financial lives through a zero-based budgeting system. This method encourages users to make a plan for every dollar they earn, promoting a proactive approach to money management.

Overview

YNAB follows the zero-based budgeting system, which requires users to allocate every dollar towards various categories like spending, savings, and debt as soon as they get paid. This approach helps users be more intentional with their money, making conscious decisions about their financial resources.

Pros

YNAB is designed specifically for hands-on zero-based budgeting, making it ideal for users who want to be intentional with every dollar. The app encourages planning ahead for financial decisions, promoting a proactive approach to money management. YNAB’s philosophy is centered around four rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money.

Cons

While YNAB has a steeper learning curve compared to some other budgeting apps, users who commit to the system often report significant improvements in their financial habits. The premium price point may be a barrier for some users.

Pricing and Features

YNAB costs $14.99 per month or $109 per year, but users can try it out in a free 34-day trial. The app offers comprehensive educational resources, including workshops, guides, and videos, to help users understand both the budgeting method and how to use the app effectively. YNAB allows users to link various financial accounts and works seamlessly across multiple platforms.

Goodbudget

For those looking for a hands-on approach to budgeting, Goodbudget is an excellent choice. This app is centered around the envelope budgeting system, allowing users to allocate their monthly income into specific spending categories, or “envelopes.”

Overview

Goodbudget is more about planning your finances than tracking previous transactions. The free version doesn’t connect to your bank accounts; instead, you manually add account balances, cash amounts, debts, and income, and then assign money to envelopes. This manual process can be beneficial for creating awareness of spending habits and encouraging conscious interaction with your budget.

Pros

Manual Control: Goodbudget offers a high level of manual control, allowing users to deliberately manage their finances. Accessibility: The app is accessible via both mobile devices and web browsers, making it versatile for different user preferences. Educational Resources: Goodbudget includes helpful educational resources, such as articles and videos, to explain envelope budgeting concepts and app functionality.

Cons

Limited Automation: The free version requires manual entry of transactions and account balances, which can be time-consuming. Limited Envelopes and Accounts: The free version has limited envelopes and account access, which may not be sufficient for all users.

Pricing and Features

Goodbudget is free, with a premium version called Goodbudget Premium available for $10 per month or $80 per year. The Premium version offers unlimited envelopes and accounts, among other features. The app’s manual approach to budgeting and its educational resources make it a valuable tool for those who prefer a more deliberate approach to managing their finances.

EveryDollar

Designed by Dave Ramsey’s company, Ramsey Solutions, EveryDollar offers a straightforward approach to managing finances. This budgeting app is centered around the principle of zero-based budgeting, where every dollar is assigned a job.

Overview

EveryDollar provides a simplified zero-based budgeting framework that’s more accessible for beginners than some of its competitors. The app follows Dave Ramsey’s financial philosophy, making it particularly appealing to followers of his money management principles. By requiring users to manually enter transactions in the free version, EveryDollar helps users become more mindful of their spending habits.

Pros

The EveryDollar app has several benefits, including:

- A clean and straightforward interface that focuses on the essentials of budgeting without overwhelming users with complex features.

- The ability to implement the “every dollar has a job” philosophy, ensuring all income is allocated to specific categories.

- A free version that’s available for users who want to try out the basics of the app.

Cons

While EveryDollar has its advantages, there are some drawbacks to consider:

- The free version requires manual entry of transactions, which can be time-consuming.

- The premium version is required to sync bank accounts and access additional features.

Pricing and Features

The basic version of EveryDollar is free, while the premium version costs $79.99 per year or $17.99 per month after a 14-day free trial. The premium version includes additional features such as bank account syncing, custom reports, and personalized recommendations based on spending patterns.

PocketGuard

For those seeking a straightforward approach to managing their finances, PocketGuard offers a compelling solution. This budgeting app is designed to simplify the process of tracking expenses, income, and financial goals, making it particularly suitable for beginners.

An Overview of PocketGuard

PocketGuard follows the zero-based budgeting framework, helping users allocate every dollar towards a specific purpose. By connecting your checking, credit, and savings accounts, you can track your bills and get a clear picture of your financial situation. The app’s “In My Pocket” calculation shows exactly how much you have available to spend after accounting for necessities, bills, and goals.

Pros

The key advantages of using PocketGuard include its simplicity, automatic expense categorization, and bill tracking features. The app also allows for manual tracking for those who prefer not to link their accounts directly. Additionally, PocketGuard provides a net worth tracking feature, giving users a comprehensive view of their financial health.

Cons

While PocketGuard offers a lot of value, it’s not without its drawbacks. Some users might find the cost, at $12.99 per month or $74.99 per year, to be a bit steep compared to other budgeting apps on the market. However, the simplicity and ease of use are significant selling points.

Pricing and Features

PocketGuard’s pricing is competitive, especially considering the range of features it offers. From automatic syncing with financial accounts to customizable categories and bill tracking, the app provides a robust set of tools to manage your finances effectively. The “In My Pocket” feature is particularly useful for understanding your available funds.

Empower Personal Dashboard

The Empower Personal Dashboard app offers a unique blend of budgeting capabilities and investment monitoring, making it an ideal choice for users who want to manage their finances comprehensively.

Main Features

Empower is primarily an investment tool, but its free app includes features helpful for budgeters looking to track their spending. You can connect and monitor various accounts, including checking, savings, credit cards, IRAs, 401(k)s, mortgages, and loans.

The app provides a spending snapshot by listing recent transactions by category, allowing you to customize categories and view total monthly spending for each.

Pros

Some key advantages of using Empower Personal Dashboard include its ability to connect various financial accounts, provide a clear spending snapshot, and offer net worth and portfolio tracking features. Its free core features make it accessible to beginners.

Moreover, the app is available across multiple platforms, including phone, tablet, and desktop, providing flexibility in accessing financial information.

Cons

While Empower’s budgeting features are solid, some users might find that its investment-centric approach leaves certain budgeting features less developed compared to dedicated budgeting apps.

Pricing and Features

Empower offers its core features completely free, making it an attractive option for those on a tight budget. The app’s main features include account monitoring, spending tracking, and net worth tracking, providing a comprehensive view of your financial status.

Monarch Money

As a powerful financial management tool, Monarch Money offers a range of features that cater to users who want to take control of their financial future.

Looking for an advanced budgeting app?

Overview

Monarch Money is designed for users who need more than just basic budgeting. It is geared towards long-term planners who want to track their expenses, investments, and net worth all in one place. The app allows users to invite an unlimited number of collaborators, making it a great tool for family budgeting or working with financial advisors.

Pros

The app offers several key benefits:

– Comprehensive financial planning: Monarch Money goes beyond simple budgeting by allowing users to track their net worth and investments.

– Collaboration features: Users can invite partners or financial advisors to view and contribute to their budget.

– Customizable dashboard: Users can compare their spending across different time periods.

Cons

While Monarch Money offers a robust set of features, there are some drawbacks:

– Cost: At $14.99/month or $99.99/year, it is positioned as a premium service.

– Complexity: The wide range of features may be overwhelming for users looking for a simple budgeting app.

Pricing and Features

Monarch Money is available at a cost of $14.99 per month or $99.99 per year. The app includes features like:

– Investment tracking

– Net worth calculation

– Goal-setting tools using a bucket system

– A calendar view for upcoming bills and expenses

Honeydue

Couples can now take control of their financial future with Honeydue, a powerful budgeting app designed to help partners manage their finances together seamlessly.

Honeydue allows both partners to sync their bank accounts, credit cards, loans, and investments, providing a comprehensive view of their financial situation. The app offers customizable privacy settings, enabling partners to control what information they share.

Overview

Honeydue is a free budgeting app that automatically categorizes expenses and allows for custom categories, making it easier for couples to track their spending. The app’s standout feature is its communication tools, including in-app chat and emoji reactions to transactions, facilitating financial conversations between partners.

Pros

The budgeting app offers several benefits, including the ability to set monthly spending limits for different categories and receive alerts when approaching these limits. Honeydue also includes bill reminders and a calendar view of upcoming expenses, helping couples stay on top of their financial obligations.

Cons

While Honeydue offers impressive functionality, it lacks some of the advanced features found in paid apps. However, its completely free nature makes it an attractive option for couples on a budget.

Pricing and Features

Honeydue is a completely free budgeting app with no premium tier, offering a range of features that cater to couples’ financial needs. The app’s simplicity and ease of use make it an excellent choice for partners looking to manage their finances together.

NerdWallet Money Tracker

![]()

Managing your finances just got easier with NerdWallet Money Tracker, a free app that tracks your spending. This tool is designed to help users monitor their financial health by tracking various accounts, including bank, credit card, and investment accounts.

Overview

NerdWallet Money Tracker offers a comprehensive financial dashboard that allows users to track their spending across multiple accounts. The app’s cash flow view makes it easy to compare the current month’s spending to previous months, helping users identify trends and patterns in their financial habits.

Pros

Key benefits of NerdWallet Money Tracker include its ability to automatically categorize transactions and provide insights into spending patterns. Additionally, it offers credit score monitoring and credit report information, helping users understand and improve their credit health. The app also compiles upcoming bills in one place, making it easier to avoid missed payments.

Cons

While NerdWallet Money Tracker is a robust tool, it focuses more on tracking past spending rather than planning future expenses. Some users may also notice that the app offers personalized financial product recommendations, which can appear as ads within the interface.

Pricing and Features

The best part about NerdWallet Money Tracker is that it’s completely free, with no premium tier. This makes it an attractive option for beginners looking to gain better visibility into their spending without committing to a paid subscription. The app’s features include account tracking, budgeting insights, and credit score monitoring, making it a solid choice for those seeking a free budgeting solution.

Best Budgeting Apps for Specific Needs

Different financial situations require different approaches, and certain budgeting apps are better suited to specific needs. Whether you’re managing finances with a partner, adhering to a strict budgeting method, or monitoring your investments, there’s a budgeting app designed to meet your requirements.

Best for Couples

Honeydue stands out as a top choice for couples managing finances together. Its features, such as shared account visibility, transaction commenting, and bill reminders, help partners coordinate their financial responsibilities seamlessly.

Best for Zero-Based Budgeting

For those who follow the zero-based budgeting method, YNAB and EveryDollar are excellent choices. While YNAB offers comprehensive educational resources, EveryDollar provides a simpler, more beginner-friendly interface.

Best Free Option

Budget-conscious users can benefit from Empower Personal Dashboard or NerdWallet Money Tracker, which offer robust tracking capabilities without any subscription fees.

Best for Investment Tracking

For investors looking to monitor their spending and investment portfolio in one place, Empower and Monarch Money are particularly valuable due to their comprehensive asset tracking features.

Each budgeting app has its unique strengths, making it crucial to choose one that aligns with your specific financial situation and preferences. Consider taking advantage of free trials offered by premium apps to determine the best fit for your financial style.

How to Get Started With Your Budgeting App

To take control of your finances, you need to get started with your budgeting app, a process that’s easier than you might think. The key to a successful budgeting journey is setting up your app correctly and utilizing its features to their fullest potential.

Setting Up Your Accounts

Most budgeting apps require you to connect your financial accounts to track your spending and income effectively. This typically involves syncing your bank, credit card, and investment accounts. The good news is that most apps use secure tokenization methods to connect to your accounts, ensuring your login credentials are safe.

Creating Your First Budget

When creating your first budget, it’s essential to review your recent spending history to establish realistic category limits. Many budgeting apps will suggest budget categories based on your spending patterns, which you can then adjust to better reflect your priorities and financial goals.

Establishing Financial Goals

Setting specific, measurable financial goals within your app is crucial for staying motivated and tracking your progress. Whether it’s building an emergency fund or saving for a vacation, having clear goals in place helps you stay focused on your financial objectives.

By following these steps and taking advantage of the educational resources offered by many budgeting apps, you can maximize the app’s features and develop better financial awareness.

Security Considerations for Budgeting Apps

The security of your financial data is paramount when choosing a budgeting app. As you connect your bank accounts and credit card information, it’s essential to understand how these apps protect your sensitive data.

How Apps Protect Your Financial Data

Reputable budgeting apps employ robust security measures to safeguard your financial information. They use bank-level encryption, typically 256-bit, to protect your data during transmission and storage. This makes it extremely difficult for unauthorized parties to access your information.

Most budgeting apps also utilize a tokenization system when connecting to your bank accounts. This means they don’t store your actual login credentials but instead use secure digital tokens for authentication. Many apps are designed to be “read-only,” allowing them to view your financial information without making transactions or changes to your accounts.

- Look for apps that offer two-factor or multi-factor authentication to add an extra layer of security.

- Check the app’s privacy policy to understand how they use your data and whether they share it with third parties.

Best Practices for Keeping Your Information Safe

While budgeting apps implement robust security measures, there are steps you can take to further protect your information. Using unique, strong passwords for your budgeting app and enabling biometric authentication, if available, can significantly enhance security.

It’s also crucial to only connect to your financial accounts through secure networks. Regularly monitoring your connected accounts for any suspicious activity is an additional precautionary measure.

| Security Feature | Description | Benefit |

|---|---|---|

| Bank-Level Encryption | 256-bit encryption for data protection | Protects data during transmission and storage |

| Tokenization System | Uses digital tokens instead of login credentials | Enhances security by not storing sensitive login information |

| Two-Factor Authentication | Adds an extra layer of security beyond passwords | Reduces the risk of unauthorized access |

Conclusion: Taking Control of Your Financial Future

Taking control of your financial future is easier than you think with the right budgeting app. As you have seen, various apps can help you manage your money, track your spending, and work toward your goals.

When choosing a budgeting app, it is essential to consider your specific financial situation, goals, and the level of involvement you want in managing your money. The best app for you is one that you will use consistently, so prioritize user experience and interface preferences alongside features.

Using a budgeting app can lead to meaningful behavioral changes and improved financial habits over time. It is crucial to remember that these apps are tools to support your financial journey, not magical solutions—they require your engagement and willingness to make changes based on the data they provide.

As you start your journey, consider beginning with a free app to establish the habit of budgeting before investing in a premium option with more advanced features. As your financial situation evolves, do not hesitate to switch apps if your current one no longer meets your needs. The ultimate goal of any budgeting app is to help you gain control over your finances, reduce financial stress, and work toward a more secure financial future.

FAQ

Are budgeting apps safe to use with my bank accounts and credit cards?

Can I use a budgeting app if I’m not tech-savvy?

How do budgeting apps help with zero-based budgeting?

Can budgeting apps help me improve my credit score?

Are there any free budgeting apps that offer robust features?

How do I choose the best budgeting app for my needs?

Can I use multiple budgeting apps at once?

Eduard Kingly is a travel and lifestyle content creator with a focus on personal development and education. He combines firsthand travel experiences with research-driven insights to guide readers in discovering new places, building better habits, and pursuing meaningful learning.