Envelope Savings Challenge: Simple Steps to Reach Your Goals

What if managing your finances felt more like a game than a chore? A creative budgeting method is taking social media by storm, helping people rethink how they handle their cash. This approach combines visual organization with bite-sized milestones, making progress feel tangible and rewarding.

Unlike apps or spreadsheets, this strategy uses physical tools to create a direct connection between effort and results. Many find it easier to stay motivated when they can see their achievements stacking up. The method’s popularity stems from its flexibility—it works whether you’re setting aside $5 or $50 daily.

Gamification transforms routine money management into something engaging. By breaking larger objectives into daily actions, users experience regular wins that fuel consistency. Over 72% of participants in recent surveys reported sticking with this tactic longer than digital-only systems.

This hands-on framework also builds accountability. Watching your progress unfold creates natural checkpoints to celebrate success or adjust strategies. Best of all, the system adapts to different income levels and timelines, proving effective for short-term targets and long-term dreams alike.

Key Takeaways

- Visual, tactile methods boost motivation better than digital tracking alone

- Daily milestones make large financial goals feel achievable

- Physical progress tracking creates stronger accountability

- Flexible framework works for various budgets and timelines

- Social media communities provide ongoing support and ideas

- 72% of users stick with this method longer than app-based systems

The Basics of the Envelope Savings Challenge

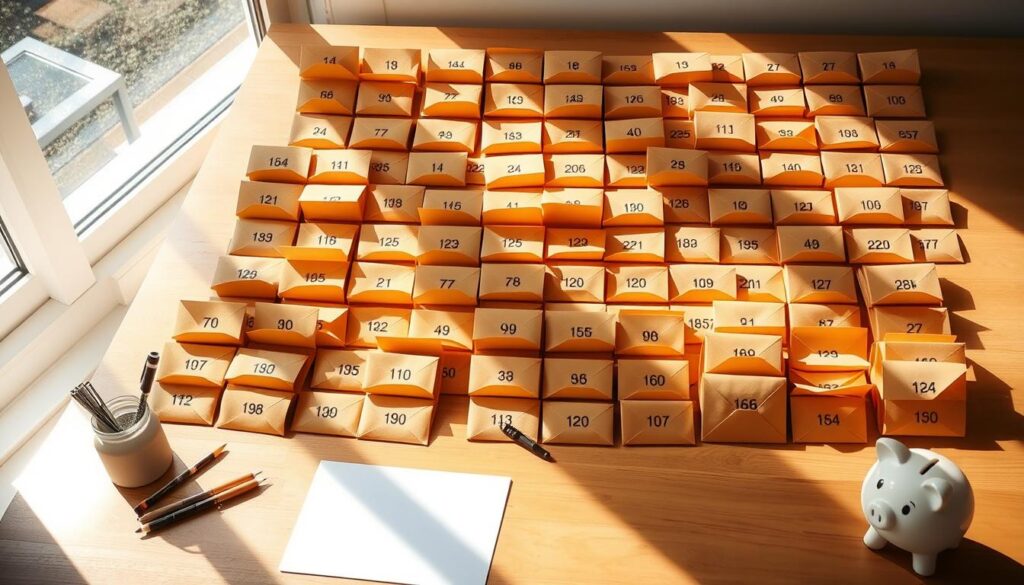

Transforming spare change into significant savings starts with numbered containers and a dash of surprise. This method uses 100 labeled items (1-100) and a daily random draw to determine your deposit amount. If you pick #43, that’s your target for the day. Complete all selections, and you’ll accumulate $5,050 without complex calculations.

Understanding the Concept

The system thrives on simplicity. Number physical or digital containers from $1 to $100. Each day, choose one blindly—the number dictates your cash commitment. Digital users can pair apps with bank transfers for seamless tracking.

Randomization keeps things fresh. Not knowing whether you’ll save $8 or $80 tomorrow creates playful anticipation. This unpredictability helps bypass the boredom that sinks rigid plans.

Why It Works as a Savings Habit

Physically handling money strengthens financial awareness. Watching stacks grow creates visible proof of progress—a powerful motivator missing in app-only tracking.

Daily actions rewire money habits through repetition. Small wins build confidence, while the structured approach tackles procrastination. As one user shared: “Seeing my collection expand made skipping days unthinkable.”

Your Step-by-Step Guide to Kickstart Savings

Ready to turn financial discipline into an exciting routine? Let’s break down the setup process and explore flexible options that fit different lifestyles.

Gathering Materials and Setting Up

First, collect 100 blank containers—standard mailing ones work well. Number each from $1 to $100 using bold markers for visibility. Store them in a shoebox or decorative tray for easy access. Pro tip: Color-code odd/even numbers to quickly spot patterns in your selections.

Establish a daily ritual: Shuffle the stack each morning and draw one without peeking. Deposit the amount shown—$18 for #18, $92 for #92. Keep completed ones in a separate folder to track your 100-day progress. “The physical act of moving them makes it feel real,” notes a Reddit user who saved $3,000 in four months.

Daily or Weekly Variations Explained

Biweekly earners can adapt the system with 26 containers. Divide your total goal by 26—for $5,050, aim for $194 per paycheck. Weekly savers might use 52 envelopes, contributing $97 each Friday. Prefer smaller commitments? Stretch the timeline to 200 days by selecting two containers weekly.

Digital enthusiasts can pair a random number generator with automatic transfers. Apps like NumberShuffle mimic the surprise factor while syncing with your bank. Either way, the core principle remains: Regular, unpredictable deposits build momentum better than fixed routines.

Envelope Savings Challenge: How It Builds a Savings Habit

Ever wonder why some money habits stick while others fizzle out? The secret lies in turning routine actions into engaging experiences. Our brains crave novelty and rewards—elements this approach masters through playful unpredictability.

Simple Daily Savings and Gamification

Randomized daily targets activate your brain’s reward centers like a slot machine. When you draw #17 instead of #89, the relief or excitement creates emotional stakes. “It feels like beating a mini-game each time I complete a number,” shares a TikTok user who saved $2,100.

Neuroscientists confirm it takes 66 days to form habits. The 100-day structure provides extra practice, making financial discipline automatic. Colorful progress charts or sticker trackers amplify this effect—visual proof of growth keeps motivation high.

Adjusting the Challenge to Fit Your Budget

Struggling with higher numbers? Halve all amounts (#50 becomes $25) or pick two envelopes weekly. One parent shared: “We modified it to $0.50 increments—still reached $1,000 for summer camp.”

Celebrate every 10 completed deposits with small rewards. Bake cookies at $200 saved, or watch a movie at $500. These joyful checkpoints combat burnout while keeping eyes on the ultimate goal.

Digital tools help too. Apps can auto-transfer randomized amounts from checking accounts. Pair this with a dedicated savings account to watch your balance climb—a modern twist on the classic method.

Exploring Alternative Budgeting Methods and Money-Saving Strategies

Financial success isn’t one-size-fits-all—explore how different budgeting styles stack up against tactile systems like the 100 envelope challenge. While numbered containers work for impulsive spenders, other approaches might better suit planners or tech-focused savers.

Comparing Tactical Systems

The classic 50/30/20 rule divides income into needs, wants, and savings—ideal for those needing structure without daily tasks. Zero-based budgeting assigns every dollar a job, while “pay yourself first” prioritizes savings. Cash stuffing differs by making spending limits physically tangible, which research shows reduces impulse buys by 23% compared to digital tracking.

Blending Old-School and Modern Tools

Hybrid systems bridge physical and digital worlds. Apps like Goodbudget mimic envelope categories electronically, while automated transfers pair with random number generators. Financial coach Kelley Kahler advises: “Use short-term challenges to break bad habits, then layer in apps for long-term tracking.”

Building Beyond Quick Wins

Once you’ve mastered the envelope challenge, expand your strategy. Allocate saved funds to specific goals—30% for emergencies, 50% for debt, 20% for vacations. Combine methods: Use cash stuffing for flexible categories like groceries, while automated transfers handle fixed bills. This creates a customized framework that grows with your ambitions.

Conclusion

Reaching financial milestones becomes achievable when you turn saving into a daily adventure. The 100 envelope method proves that stacking small amounts consistently can add up to $5,050 in just over three months. Beyond the numbers, this approach rewires how you interact with money—making conscious choices feel rewarding rather than restrictive.

Once you’ve completed the initial 100-day cycle, adapt the framework for specific targets. Use modified versions for vacation funds or emergency cushions. Many find the tactile nature of handling cash creates lasting awareness that digital transactions often lack.

Consider this system a launchpad for broader financial health. The confidence gained from hitting daily targets prepares you to tackle debt repayment or investment strategies. Pair your progress with professional guidance—a financial advisor can help convert short-term wins into lifelong stability.

FAQ

How does this method help build better money habits?

What if I can’t afford to set aside larger amounts each week?

Can I combine this strategy with apps like Mint or YNAB?

What happens if I skip a day or fall behind?

How is this different from the 50/30/20 rule?

Are there options for long-term goals like buying a home?

Eduard Kingly is a travel and lifestyle content creator with a focus on personal development and education. He combines firsthand travel experiences with research-driven insights to guide readers in discovering new places, building better habits, and pursuing meaningful learning.